Relocating Made Easy:

Tips For A Smooth State-To-State Move

The logistics of an “in-town” move are daunting enough, but managing a state-to-state move can be overwhelming. However, you can be comforted by the fact that we’ve helped our clients manage it many times before, and we can do it successfully for you as well.

Here are some elements of that process that may help you with your move.

Make A Familiarization Trip

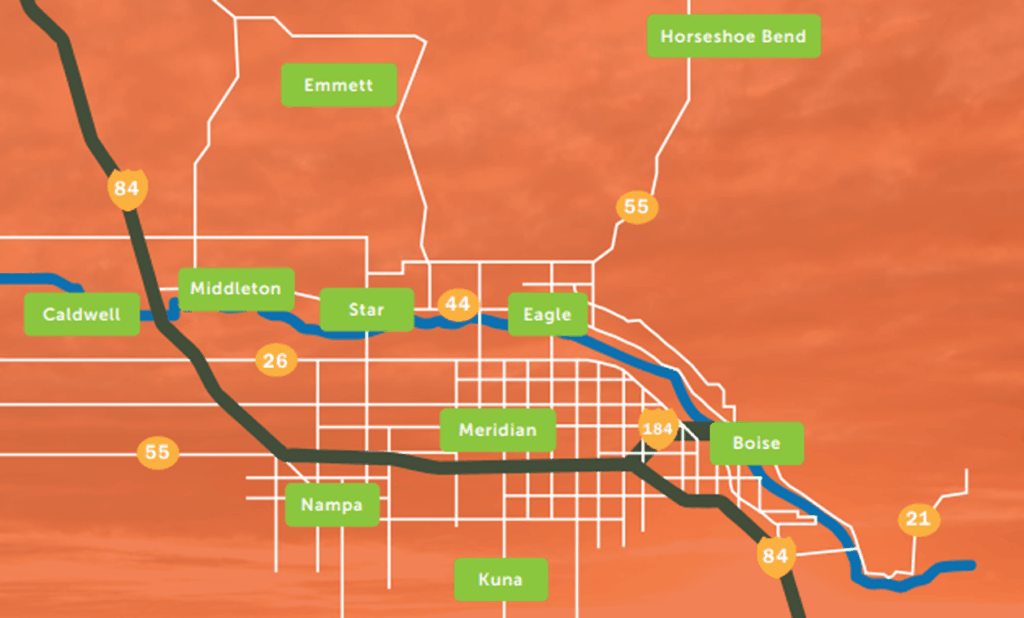

There are lots of great locations in which to live in the Treasure Valley. So, the best place really depends on what someone’s living style and needs are. For someone contemplating relocating to this area, an orientation visit is usually the first step. To make it most productive for our clients, we are their guides. We prefer at least two days, the first as a geographical familiarization, and the remaining time for serious home searching.

For the first day, we find a number of listings that match the client’s home feature preferences in different areas. What this provides is both an exposure to the different neighborhoods across the valley, and a practical example for what their money buys in those areas.

By the end of day one, we have gained a much better feel for what the client likes. So, for Day Two’s serious home searching, we gather listings that most closely match the client’s wish list located in the Day One areas that were found to be the most attractive.

Let us know when you plan to visit, and we’ll schedule you on our calendar.

The Purchase Process Timeline

Establishing a time-line against which to manage everything involved in relocating must be the first thing you do. Primary in that, is identifying all that needs to occur, and their order. The Listing Agent whom you’ll engage to help sell your house can advise you on your current local-market activity level – like, how many days your house might be on the market before receiving an acceptable offer, and how long thereafter the escrow period might be.

He or she can also consult with you as to what preparation is necessary before actively listing your house for sale.

On this end, we can tell you that once you’ve found a home here and gotten an offer accepted, the pending period to closing is 40 to 45 days. But, finding that new house will be an unknown block of time. Based on when you accept an offer on your departure house, we start lining up homes for sale here that match your preferences. It would be best if you could come here, so we could show you these candidate-properties personally (although, we’ve done the whole process remotely more than once – what with the assistance of apps like Facetime, etc.).

If you would like to see the Flow Chart full size, with an

explanation of each step, click here.

Based on your situation, you’ll make your move in one of three ways:

1 – If your financial wherewithal is such that you don’t need the proceeds from the sale of your house to put forward on the next, you can find your new house here, and then sell.

2 – You may decide that you will transition to a temporary residence in-between.

3 – Finally, like most buyers, the sale and purchase will need to be simultaneous, so the proceeds from the sale can contribute to the purchase of the new home. Once a house is found, we can include in the offer negotiations a request for any closing date flexibility that might be preferable.

The only challenge with that third scenario is that any offer you make on a house will be contingent on the closing of your sale. That’s not the strongest negotiating position. Also, in a multiple offer situation you may be competing against non-contingent and/or cash offers.

We’ve drifted off topic a bit. But, everything about the whole process has an effect on the timeline.

Choosing A Lender

One of the first steps to take after making the decision to move to the Boise area, is to engage a Mortgage Lender (well . . .unless you’re going to pay cash). A Pre-Approval letter from a lender will be an important inclusion when submitting an offer. A local lender is preferable for several reasons, primarily because they’re here and are familiar with the region and its lending ins and outs – and, this is where you’ll end up.

If you don’t have a affiliation with a national bank or lender, we can offer the names and contact info of local mortgage lenders and financial institutions we have worked with successfully for you to choose from.

Locating for a Proximity

The the primary reason for your move to this area might have been for things like job, cost of living, schools, medical facilities, area culture, or weather.

But, exactly where, here, you want to locate might have to do with certain needs . . .work commute, for example, or proximity to a medical facility, or a need to be conveniently located near a certain educational facility.

We can take those needs into consideration when searching for properties. If you’ve downloaded our Relocation Guide, you may have already found some potential areas from its description of the different cities in the Treasure Valley. Together with that, our familiarity with the area will allow us to show you locations with the most potential for meeting your preferences.

What to buy?

. . .an existing Home, or new construction?

If your preferences are broad enough to include considering the purchase of new construction as well as an existing home, then you need to know what each does, and doesn’t bring to the table.

An existing home will have mature landscaping. The house will most likely have window fixtures and treatments. The neighborhood will be established – you’ll be able to see how the neighbors take care of their property.

A new home will have a brand new roof and mechanical systems. It will be “brand-new” clean. The appliances will be waiting to be used for the first time.

An existing home will have some age on the mechanical systems. The water heater and HVAC may, or may not be the same age as the house. The same goes for the roof. Existing homes that are move-in-ready appeal to a broad buying audience. Those in good condition support their asking price, and attract more interest.

A new home will have a landscaped front yard. However, the back yard may not be. The same may go for fences between neighboring homes. Most of the windows in the house will need coverings. The garage may be sheetrocked, and even painted. But, there will be no storage shelves or cabinets.

When you find the home with the perfect floor plan, and in a desirable location, it could very well be either an existing home or new construction (either to-be-built, under construction, or new-never-occupied). That’s when you can apply the forgoing considerations in your decision making process.

Shirley has designed and built houses, and Alan has worked for major national builders and is a Certified New Home Sales Professional by the National Association of Home Builders.

When we go through a property, we’re looking at it more critically than our client. That’s our developed habit. We form an opinion about the house. Most of which we keep to ourselves because the house is not for us, it’s for our client. But, those things we notice that are an issue, we bring to the client’s attention.